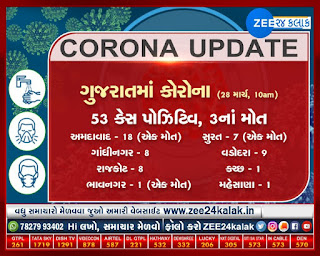

corona virus gujarat update official press note 25-3-20202

Corona care is unchanged in Gujarat. On the issue of Corona status, Health Principal Secretary Jayanti Ravi told reporters today that a total of 38 Corona positive cases have been registered in the state.

Which has three local patients. Most cases are in Ahmedabad. A total of 14 positive cases have been registered in Ahmedabad till date. In Surat and Vadodara, 7 positive cases were registered, 7 in Gandhinagar and 3 in Rajkot and 1 in Kutch. A family from Mumbai in Veraval village in Idder, Sabarkantha, violated government rules. Complaints have been lodged not to be isolated as per government norms. A complaint has been registered against 14 persons by Eder police.

Update Gujarat

>> Vegetable Market facility opened at Ellisbridge Riverfront Gujri Bazaar in Ahmedabad

>> CM Relief Fund opened to help poor and middle class people and deliver life necessities

>> Vegetable Market facility opened at Ellisbridge Riverfront Gujri Bazaar in Ahmedabad

>> CM Relief Fund opened to help poor and middle class people and deliver life necessities

Insurance and the insurance industry has developed, expanded and grew essentially from that point forward. Insurance organizations were, in huge part, disallowed from composing more than one line of insurance until laws started to allow multi-line contracts during the 1950s. From an industry commanded by little, nearby, single-line shared organizations and part social orders, the matter of insurance has developed progressively towards multi-line, multi-state, and even multi-national insurance aggregates and holding organizations

State-based insurance administrative framework

Verifiably, the insurance industry in the United States was managed solely by the individual state governments. The primary state magistrate of insurance was delegated in New Hampshire in 1851 and the state-based insurance administrative framework developed as fast as the insurance industry itself.[9] Prior to this period, insurance was basically controlled by the corporate sanction, state statutory law and true guideline by the courts in legal choices.

Prime Minister is addressing the nation live to share some vital aspects relating to the menace of Coronavirus or COVID19.The United States Supreme Court found in the 1944 instance of United States v. South-Eastern Underwriters Association that the matter of insurance was liable to government guideline under the Commerce Clause of the U.S. Constitution. The United States Congress, be that as it may, reacted very quickly with the McCarran-Ferguson Act in 1945. The McCarran-Ferguson Act explicitly gives that the guideline of the matter of insurance by the state governments is in the open intrigue. Further, the Act expresses that no bureaucratic law ought to be understood to discredit, weaken or supplant any law sanctioned by any state government to control the matter of insurance except if the administrative law explicitly identifies with the matter of insurance.

source :- divya bhaskar

source :- divya bhaskar

An influx of insurance company bankruptcies during the 1980s started a recharged enthusiasm for government insurance guideline, including new enactment for a double state and administrative arrangement of insurance dissolvability regulation.[16] accordingly, the National Association of Insurance Commissioners (NAIC) embraced a few model changes for state insurance guideline, including hazard based capital necessities, money related guideline accreditation measures and an activity to systematize bookkeeping standards. As an ever increasing number of states authorized renditions of these model changes into law, the weight for government change of insurance guideline wound down. Notwithstanding, there are as yet critical contrasts between states in their frameworks of insurance guideline, and the expense of consistence with those frameworks is at last borne by insureds as higher premiums. McKinsey and Company assessed in 2009 that the U.S. insurance industry causes about $13 billion every year in pointless administrative expenses under the state-based administrative frameworkThere is a long-running discussion inside and among states over the significance of government guideline of insurance which is perceptible in the various titles of their state insurance administrative offices. In numerous states, insurance is directed through a bureau level “division” as a result of its financial significance. In different states, insurance is controlled through a “division” of a bigger branch of business guideline or money related administrations, in light of the fact that raising an excessive number of government offices to offices prompts managerial confusion and the better alternative is to keep up a reasonable levels of leadership.

DATE :- 28/03/2020 PRESS NOTE :